Buying your first home in Windsor, Ontario is a big milestone — and yes, it can feel overwhelming, especially if you’re new to buying a home in Canada. The good news? You’re not alone. Thousands of people are making Windsor and Essex County their new home because of its affordable housing, growing communities, and beautiful waterfront views.

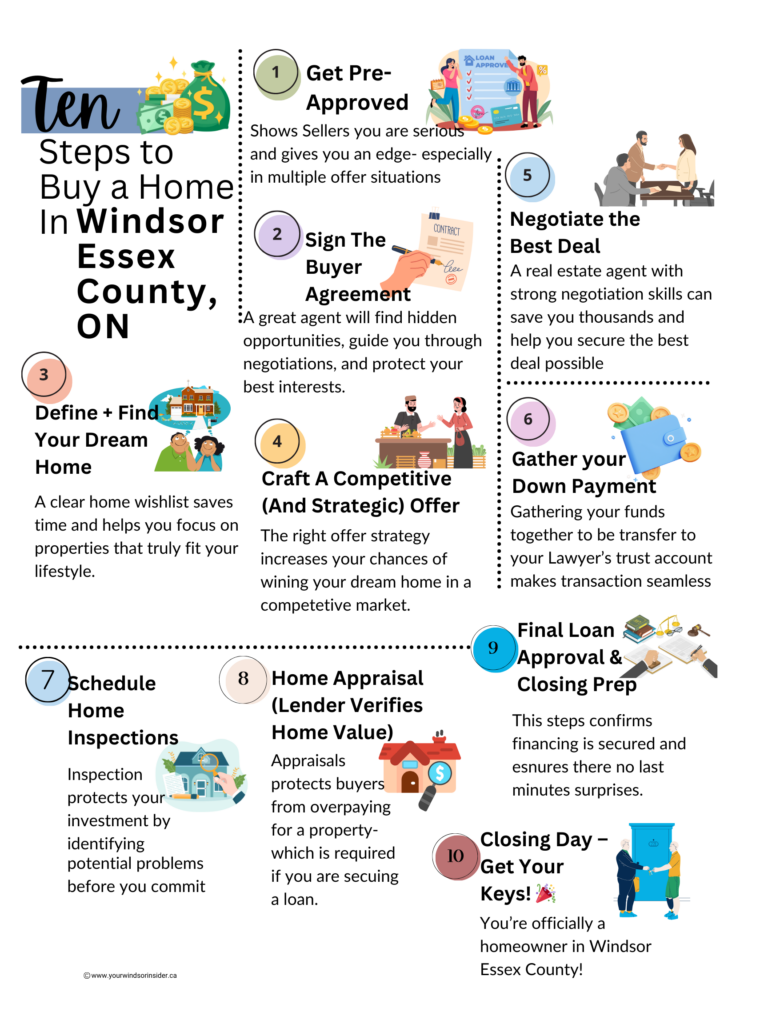

Here’s my proven, 10 Step Process to that helps my clients buy their dream home in Windsor Ontario — even in the toughest markets!

Table of Contents

Step 1: Get Pre-Approved

Why Pre-Approval Matters:

Before you start dreaming about your new home in Windsor-Essex County, you need to know what you can actually afford. Getting pre-approved for a mortgage means a lender looks at your income, debts, credit score, and tells you how much they’re willing to lend you.

This step saves you time, keeps your search realistic, and shows sellers you’re serious.

Watch Out For:

Don’t make big purchases before closing (like buying a new car) — it could mess up your pre-approval.

Interest rates fluctuate — lock in a rate if possible.

Shop around — banks and mortgage brokers may offer different dea

Common Misconception:

Many first-time home buyers in Canada think pre-approval means they’re guaranteed the loan — but that’s not true. Pre-approval is not a final approval; it’s a starting point.

Step 2: Sign The Buyer Agreement

Why It’s Important:

In Ontario, signing a Buyer Representation Agreement means your real estate agent is officially working for you — not the seller. They’ll negotiate for you, protect your interests, and guide you through the process.

Watch Out For:

- Ask about the length of the agreement — it’s usually negotiable.

- Be clear about what services they provide (home search, negotiations, paperwork).

- Choose an agent who knows Windsor-Essex County like the back of their hand.

Common Misconception:

Some buyers think signing an agreement locks them in forever — but most agreements have time limits and can be negotiated.

Step 3: Define + Find Your Dream Home

Why This Matters:

It’s time to separate your needs from your wants.

Do you need a pool? Or do you just want to impress your friends from Toronto?

Knowing your non-negotiables (like location, number of bedrooms, yard space) will help you narrow down your search.

Watch Out For:

- Research Windsor-Essex County neighbourhoods (Walkerville, Tecumseh, LaSalle, Kingsville).

- Drive around at different times of day — does the neighbourhood feel safe and friendly?

- Check commute times, schools, parks, and local amenities.

Misconception:

“My first home has to be perfect forever.”

Not at all. This is a stepping stone, not a wedding vow.

Step 4: Craft A Competitive (And Strategic) Offer

Why This Matters:

Windsor-Essex County has become more competitive in recent years. Crafting a competitive offer means balancing price, conditions, and flexibility. Sometimes it’s not the highest offer that wins — it’s the cleanest, fastest, or most convenient for the seller.

Watch out For

Consider conditions like financing, home inspection, or flexible closing dates.

- Be ready for bidding wars — but set your max price and stick to it.

Here’s how we craft a smart, strategic offer that gets accepted—even when it’s not the highest on the table:

- Use data to guide your offer: We’ll analyze recent comps so your offer is competitive—but not overpriced.

- Protect yourself with smart contingencies: We’ll include financing, appraisal, and inspection contingencies to give you peace of mind—while still showing the seller you’re ready to go.

- Offer meaningful earnest money: Putting down 1–3% of the purchase price signals that you’re committed.

- Tighten up your timelines: Shorter contingency periods can make your offer more appealing—without adding unnecessary risk.

- Limit seller requests: The fewer concessions you ask for, the more confident and clean your offer looks.

- Match the seller’s ideal closing date: We’ll find out what works for them—and structure your timeline to fit.

- Deliver a clean, complete offer package: A well-prepared offer communicates confidence and professionalism—two things sellers trust.

Misconception:

“The highest offer always wins.”

Nope. Sometimes the seller wants a fast closing or fewer conditions.

Step 5: Negotiate The Best Deal

Why This Matters:

Negotiation is where you can save money or get better terms. Think repairs, appliances included, or closing dates that work for you.

Watch Out For:

Stay calm — let your agent handle negotiations.

Don’t get emotional — be ready to walk away if needed.

Focus on the big picture — don’t lose a great house over minor details.

Misconception:

“Negotiation is aggressive.”

Actually, good negotiation is respectful, clear, and professional.

Step 6: Gather Your Down Payment

Why This Matters:

Your down payment in Canada is usually 5% to 20% of the home price. Windsor-Essex County homes are more affordable than other parts of Ontario, but a down payment is still a big step.

Watch Out For:

Make sure your down payment funds are in your account early — lenders verify this.

Understand that if you put less than 20% down, you’ll need mortgage insurance (CMHC).

Factor in other closing costs — not just the down payment!

Misconception:

“I need 20% down to buy a home.” False. Many first-time buyers purchase with 5% down (plus insurance).

Step 7: Schedule Home Inspections

Why This Matters:

A home inspection can save you thousands of dollars in unexpected repairs. Don’t skip it — even if the house looks perfect.

Watch Out For:

Choose a certified home inspector familiar with Windsor-Essex County homes.

Ask questions during the inspection.

Look out for red flags: roof issues, foundation cracks, water damage.

Misconception:

“New homes don’t need inspections.” Big myth. Even new construction can have hidden issues.

Step 8: Home Appraisal (Lender Verifies Home Value)

Why This Matters:

Your lender hires an appraiser to confirm the home’s market value. If the appraisal comes in lower than your offer price, your agent will renegotiate terms. If it meets or exceeds the price, the deal moves forward!

Watch Out For:

Appraisals are standard — don’t panic.

If the appraisal comes in low, your agent can help renegotiate or advise your next steps.

Misconception:

“An appraisal checks the home’s condition.”

Nope — it’s purely about market value.

Step 9: Final Loan Approval & Closing Prep

All conditions (also called contingencies) have been removed — this means we’ve met all the requirements in your offer to move forward.

Any issues from the home inspection have been reviewed and resolved — whether that’s repairs, credits from the seller, or confirming the home is safe and sound.

You’ve secured home insurance — this is required before closing to protect your new home.

A title search has been conducted — this checks the property’s history to make sure there are no legal issues, unpaid taxes, or claims against the property.

- Title insurance has been arranged — protecting you (and your lender) from future title disputes.

The lender issues the “clear-to-close” — this is the official green light that your mortgage is ready, and all conditions have been satisfied.

A final walkthrough of the home is completed — this is your chance to check that the property is in the same condition as when you bought it, and that any agreed-upon repairs have been completed.

Why This Matters:

This is the final stretch. Lenders will double-check everything: your job, your credit, your down payment.

You’ll also need to prepare for closing costs — which can include legal fees, title insurance, and the Ontario Land Transfer Tax.

Watch Out For:

Don’t take on new debt before closing (no new car loans or credit cards).

Review all documents carefully.

Set aside 1.5% to 4% of the home price for closing costs.

Misconception:

“Pre-approval means final approval.” Sadly, no. Final approval happens after everything checks out.

Step 10: Closing Day – Get Your Keys! 🎉

Why This Matters:

It’s official! You’ll meet with your lawyer, sign all documents, and finally receive the keys to your new home in Windsor, ON.

Time to celebrate, take a photo on the front porch, and maybe start Googling “how to assemble IKEA furniture.”

Sign the final paperwork at your Lawyer’s.

Funds are transferred and the title is recorded in your name.

Watch Out For:

Funds must clear before keys are released — this could be late afternoon.

Double-check your utilities are set up.

Book your moving truck for later in the day (just in case).

Misconception:

“Closing day means early morning keys.” Not always — be flexible.

Final Thought: Your Home Buying Adventure Awaits

Buying a home in Windsor doesn’t have to be stressful. With a trusted local agent, the right steps, and a little patience, you can navigate the process like a pro.

Remember — every home buying journey is a little different. Stay informed, stay flexible, and don’t forget to celebrate when you finally get those keys!

Need help buying a home in Windsor-Essex County? Reach out — I’m always here to help guide you home.

- Email: hello@yourwindsorinsider.ca

- Call/text: 226 799 5494